PCI DSS Compliance Checklist for US E-commerce Businesses

Ensure secure online transactions. Follow our PCI DSS compliance checklist tailored for US e-commerce businesses to protect customer credit card data and maintain trust.

What is PCI DSS Compliance for E-commerce and Why Does It Matter?

Hey there! Ever wondered how your credit card info stays safe when you buy stuff online? That's where PCI DSS comes in. PCI DSS, or Payment Card Industry Data Security Standard, is like a set of rules that all businesses handling credit card info need to follow. If you're running an e-commerce store in the US, getting PCI DSS compliant isn't just a good idea – it's essential! It's all about protecting your customers' sensitive data and keeping their trust. Plus, not being compliant can lead to some serious penalties, like fines and even losing the ability to accept credit card payments. Ouch!

PCI DSS Compliance Checklist: Your Step-by-Step Guide

Alright, let's get down to business. Here’s a handy checklist to help you navigate the PCI DSS compliance process:

1. Assess Your Current Security Posture

First things first, you need to figure out where you stand. Take a good look at your systems, network, and processes. Ask yourself: Where is credit card data stored? How is it transmitted? What security measures do I already have in place? This assessment will help you identify any gaps and prioritize your efforts. Consider hiring a Qualified Security Assessor (QSA) for a professional assessment – they'll know exactly what to look for.

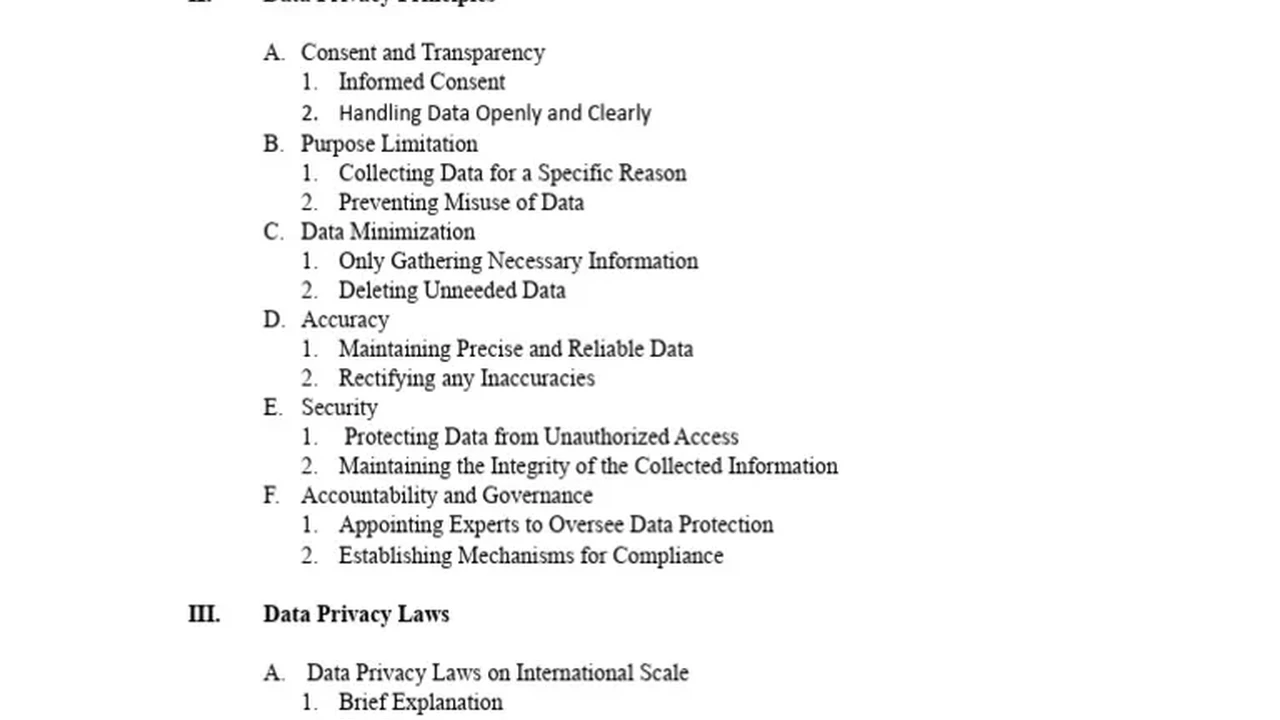

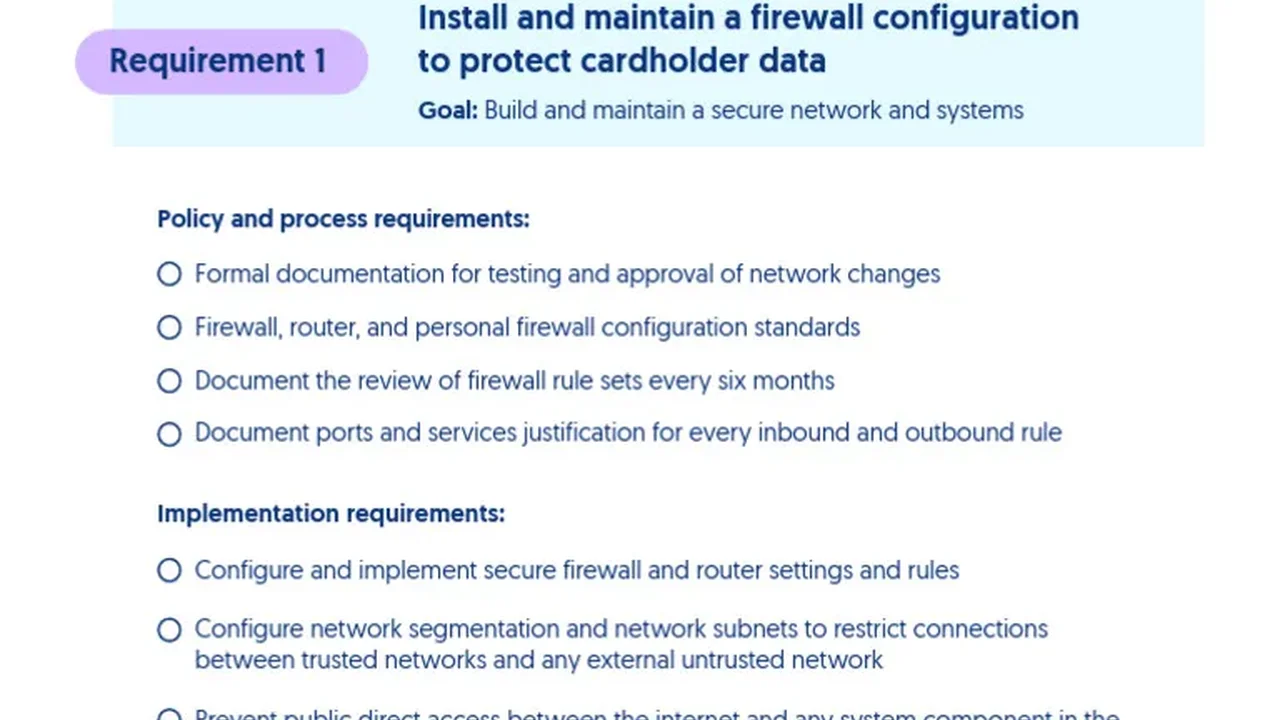

2. Secure Your Network: Firewalls and Routers

Think of your network as a castle. The firewall is the gate, keeping the bad guys out. Make sure you have a properly configured firewall and that your routers are secure. Change default passwords, keep firmware updated, and regularly review firewall rules. A strong network defense is your first line of protection.

3. Protect Cardholder Data: Encryption is Key

Encryption is like putting your credit card data in a secret code. Whether it's stored or being transmitted, encrypt it! Use strong encryption algorithms and manage your encryption keys securely. For online transactions, always use HTTPS and ensure your SSL/TLS certificates are up to date.

4. Regularly Update Anti-Virus Software: Malware Protection

Malware is like a sneaky virus that can steal your data. Keep your anti-virus software up to date on all systems that handle cardholder data. Run regular scans and make sure your software is configured to automatically update with the latest threat definitions.

5. Develop and Maintain Secure Systems and Applications: Patch Management

Software vulnerabilities are like open doors for hackers. Keep your systems and applications up to date with the latest security patches. Implement a robust patch management process and regularly scan for vulnerabilities. Don't let old software be your downfall!

6. Restrict Access to Cardholder Data: Least Privilege Principle

Not everyone needs access to credit card data. Follow the principle of least privilege, which means only granting access to those who absolutely need it. Implement strong access controls and regularly review user permissions.

7. Assign a Unique ID to Each Person with Computer Access: User Identification

Track who's doing what on your systems. Assign a unique ID to each user and require strong passwords. Implement multi-factor authentication (MFA) for an extra layer of security. This helps you monitor activity and hold individuals accountable.

8. Restrict Physical Access to Cardholder Data: Physical Security

Don't forget about physical security! Secure your servers and any physical locations where cardholder data is stored. Implement access controls, surveillance cameras, and visitor logs. Physical security breaches can be just as damaging as cyberattacks.

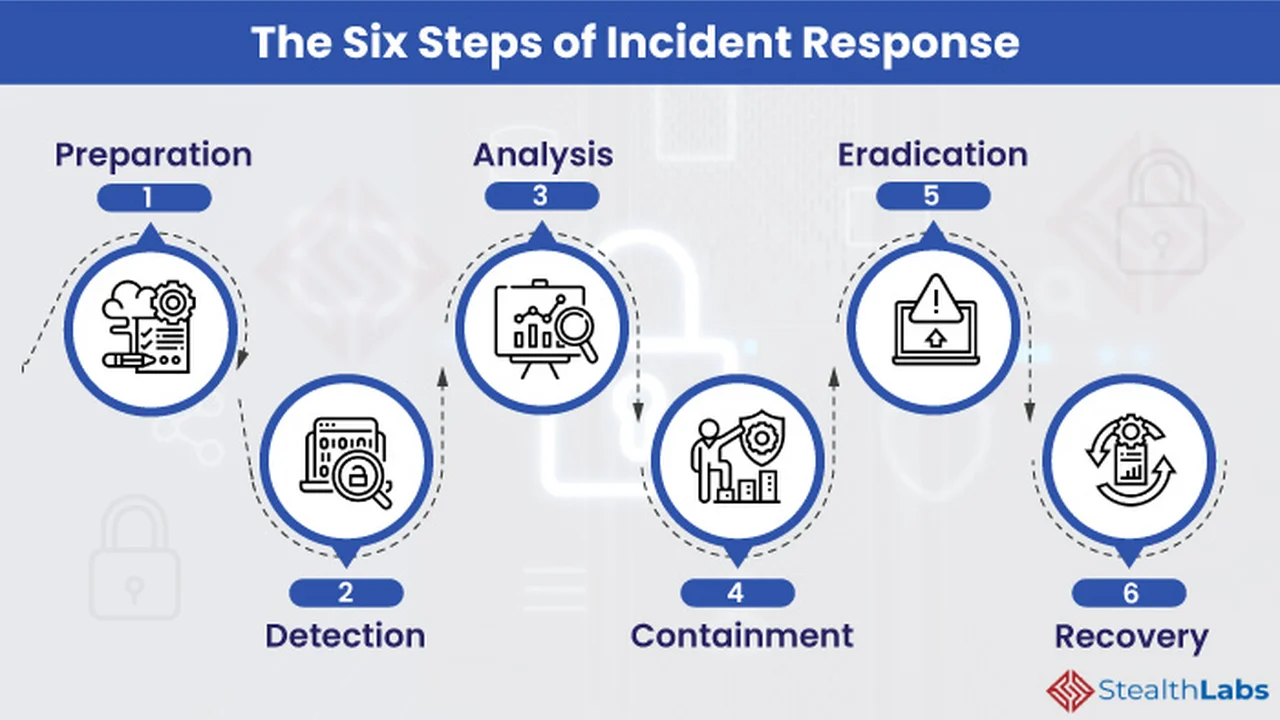

9. Regularly Test Security Systems and Processes: Penetration Testing

Think of penetration testing as hiring a friendly hacker to try and break into your systems. Regularly conduct penetration tests and vulnerability scans to identify weaknesses. Fix any issues you find promptly. This proactive approach can save you from real attacks.

10. Maintain a Policy That Addresses Information Security: Documentation is Crucial

Document everything! Create a comprehensive information security policy that outlines your security practices and procedures. Train your employees on the policy and ensure they understand their responsibilities. A well-documented policy demonstrates your commitment to security and compliance.

11. Monitor and Log All Access to Network Resources and Cardholder Data: Audit Trails

Keep a close eye on what's happening on your network. Implement robust logging and monitoring systems to track all access to network resources and cardholder data. Regularly review logs for suspicious activity. This helps you detect and respond to security incidents quickly.

PCI DSS Compliant E-commerce Platforms and Tools: Product Recommendations and Comparisons

Choosing the right tools can make PCI DSS compliance much easier. Here are a few recommendations for e-commerce platforms and security solutions:

E-commerce Platforms:

- Shopify: Shopify is a popular e-commerce platform that offers built-in PCI DSS compliance features. They handle the heavy lifting of security, so you can focus on running your business. Shopify plans range from around $29 to $299 per month, depending on the features you need. Shopify's PCI compliance covers the platform itself; merchants are still responsible for securing their individual accounts and any third-party apps they use.

- Magento (Adobe Commerce): Magento is a more customizable platform that's popular with larger businesses. While Magento itself isn't inherently PCI DSS compliant, it provides the tools and flexibility you need to achieve compliance. However, you'll need to manage your own security and hosting. Magento Commerce pricing is generally custom-quoted and can be quite expensive, reflecting its enterprise-level features and support. Self-hosted Magento Open Source is free, but requires significant technical expertise to secure and maintain.

- WooCommerce (WordPress): WooCommerce is a popular e-commerce plugin for WordPress. Like Magento, WooCommerce doesn't automatically make you PCI DSS compliant. You'll need to implement your own security measures, such as using a secure hosting provider and installing security plugins. The WooCommerce plugin itself is free, but you'll need to pay for hosting, themes, and plugins. Hosting can range from a few dollars a month to hundreds, depending on your needs.

Security Solutions:

- Cloudflare: Cloudflare offers a range of security services, including a web application firewall (WAF), DDoS protection, and CDN. These services can help you protect your website from attacks and improve performance. Cloudflare offers a free plan for basic protection, but paid plans offer more advanced features and support, ranging from $20 to $200 per month.

- Sucuri: Sucuri is another popular security provider that offers a WAF, malware scanning, and incident response services. Sucuri can help you detect and remove malware from your website and prevent future attacks. Sucuri plans range from around $200 to $500 per year.

- Qualys PCI Compliance: Qualys offers specialized PCI compliance scanning tools that can help you identify vulnerabilities and ensure you meet PCI DSS requirements. These tools automate much of the compliance process and provide detailed reports. Pricing for Qualys PCI Compliance varies depending on the size and complexity of your environment, but generally starts around $2,000 per year.

Product Comparison

| Feature | Shopify | Magento (Adobe Commerce) | WooCommerce | Cloudflare | Sucuri | Qualys PCI Compliance |

|---|---|---|---|---|---|---|

| PCI Compliance Assistance | High (Platform Level) | Medium (Tools Provided) | Low (Requires Plugins) | Medium (WAF can help) | Medium (WAF can help) | High (Specialized Scanning) |

| Customization | Medium | High | High | Medium | Medium | Low |

| Pricing | $29 - $299/month | Custom Quote (Expensive) | Variable (Hosting, Plugins) | Free - $200/month | $200 - $500/year | ~$2000+/year |

| Best Use Case | Small to Medium Businesses | Large Enterprises | Businesses needing high customization | General Website Security & Performance | Malware Removal & Website Security | Dedicated PCI Compliance Scanning |

Staying PCI DSS Compliant: Ongoing Maintenance

PCI DSS compliance isn't a one-time thing. It's an ongoing process. You need to continuously monitor your systems, update your security measures, and train your employees. Regularly review your policies and procedures and adapt them as needed. Stay informed about the latest threats and vulnerabilities. Staying vigilant is key to maintaining PCI DSS compliance and protecting your customers' data.

Need More Help? Resources for PCI DSS Compliance

Navigating PCI DSS compliance can be tricky. Here are some helpful resources:

- PCI Security Standards Council: The official website for PCI DSS standards and resources.

- Qualified Security Assessors (QSAs): Certified professionals who can help you assess your security posture and achieve PCI DSS compliance.

- Approved Scanning Vendors (ASVs): Companies that can perform vulnerability scans to help you identify weaknesses in your systems.

By following this checklist and staying vigilant, you can protect your e-commerce business and your customers from the risks of credit card fraud. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)